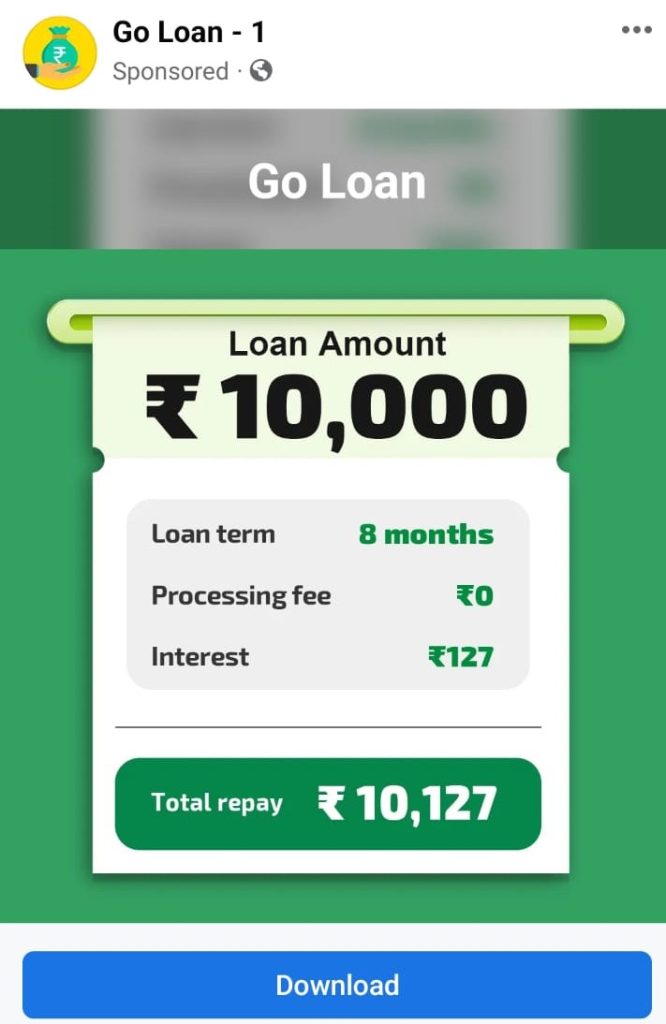

Friends, like me, have you also seen the ad of this application on Facebook or Instagram where the promise of giving loan without any processing fee is being made, let us know whether this is true or not.

Friends, B4Review is a trusted website that gives you well-researched reviews of websites, apps and technology.

Friends, in today’s post we are going to give you Go Loan App Review, is it right to take loan from this application or not, can you trust this application or not, is real or fake loan app? You will get complete information about it.

What is Go Loan?

Friends, Go loan is an online instant loan application which promises to give you instant personal loan without any processing fee and this application has been launched by AFF and Finance Limited, But this application is not available on Play Store. Why is it not available? To know this you will have to read this article completely.

According to this application, you can easily take a loan ranging from ₹ 1000 to ₹ 200,000 without any processing fee.

Application Claims

-

No paperwork

-

No Processing Fees

-

Safe and reliable

-

Fast Loan Approval

As you can see, friends, in the screenshot provided in this post, the application claims that you can simply obtain a loan ₹ 10,000 here, with a 8-month term, without providing without any bank statement and processing fee.

Go Loan Loan Details

| Application Name | Go Loan |

| Launched By | AFF and Finance Limited |

| Loan Range | ₹1k to ₹2 Lakh |

| Any type of Fees | No |

| Interest Rate | 21% [ APR } |

| Loan Tenure | 95 Days to 360Days |

| Launched Year | 2023 |

| Application Size | 32.5 MB approx |

| Total downloads | Unknow [ Not Available on Playstore ] |

| Rating on Play Store | Unknow |

| Fake or Real | Fake & Not Safe |

| Website | go-loans.one |

| Is it RBI Approved | Read Full |

Go Loan Loan App Eligibility

Friends, to take loan from Go Loan application, you will have to follow the given loan eligibility criteria, only then you will get loan from this application.

| Minimum age | 18 Years |

| Maximum age | 60 years |

| Nationality | Indian |

| Cibil Score | 600+ |

| Bank | Must Active Bank Account |

| Income | Fixed Salary |

Go Loan Required Documents

Friends, if you want to take a loan from Go Loan application, then it is mandatory for you to have these necessary documents, only then you will get the loan from this application.

- Aadhar Card

- Pan Card

- Selfie

- Email Id

- Address proof

- Mobile Number

Go Loan Customer Care Number

| Care Number | +91 92555234355 |

| Office Address | Dhawana Rd, Rewari, Srinagar, Haryana 123103, India |

| Founder Name | Not Found |

| Email id | kb876745@gmail.com |

How to take loan from Go Loan App

Friends, if you also want to take loan from Go Loan app, then you will have to follow these steps carefully, only then you can take loan from this application.

-

To take a loan, first of all you have to download this application from Play Store or its website.

-

After this you have to install this application in your phone and sign up.

-

Friends, to sign up in this application, you have to enter your mobile number and then OTP.

-

After logging in, you have to fill your personal details and upload the necessary documents for KYC.

-

Now you have to choose the loan amount and then apply the loan.

-

Now you have to wait for some time for the loan to be approved. As soon as your loan is approved, the loan amount will be transferred directly to your bank account.

But nothing like this happens because this application has been removed from the Play Store and now it is trapping people by running ads on Facebook and Instagram.

If you are thinking of taking a loan from this application, then you may get trapped in their big Scam and it may be very difficult to escape

Other Loan App Scam: Digital Bank Loan App Scam

Go Loan App Scam

Friends, now let me tell you, if you are thinking of taking a loan from this application, then which scam will you fall into? Friends, suppose, like me, you too must have seen the advertisement of this loan application on Facebook and Instagram where it is being claimed that you will easily get a loan of Rs 10,000 within 5 minutes without any processing fee.

Friends, suppose you have installed this application in your mobile and applied for a loan of ₹ 10000, and your loan gets approved within 5 minutes, then you understand that a scam has started with you.

Friends, the reality of this application is that it gives you loan only for 7 days. Yes friends, it gives you loan only for 7 days and you may have to pay 40% to 50% interest on this loan which is more than the loan amount.

And you will have to repay this loan within 7 days, which is 2 to 3 times the loan amount, for example, if you take out a loan for Rs 10,000, you will need to pay back Rs 15k to Rs 17k.

Because Go Loan is a fake application, it is neither registered by RBI nor does it have any NBFC partner. If you have taken a loan from this application then you are trapped in their Scam.

Go Loan App Harassment

Friends, now let us know if you are thinking of taking a loan from this application, then what kind of harassment can happen to you, friends, the scam will start when some loan amount comes to your account. After 5 to 6 days it will start harassing you.

For Example: Friends, the employees of this loan application can harass you a lot like these people will call you daily and send you messages and will also abuse you on calls and will harass you a lot in messages to repay the loan.

Friends, these people can harass you to a great extent to get repayment, they can even contact your contact list, and along with this, they can also threaten to scare you by making obscene pictures of you and send them to your contact list which is dangerous to you and you may even think of suicide.

Read Recent Loan Scam Suicide Case: [ Here ]

Go Loan App Real or Fake

Go Loan is a fake loan application and you must have understood that this application can scam with you, hence our opinion is that you should not take loan from this application.

friends, If you are one of the who have fallen victim to these fraudulent loan applications. Please read the article through from beginning to end, We have provided some Solution in the article that may help you escape this situation.

Go Loan App Review

Go Loan App

Go loan is an online instant loan application which promises to give you instant personal loan without any processing fee and this application has been launched by AFF and Finance Limited

Summary

Friends, our opinion is that you should not take loan from this application because Go Loan is a fake loan application which can trap you and after getting trapped, it can be very difficult to escape.

Q: Go Loan app real or fake

Ans: Go Loan is a 100% Fake Loan App, once you get trapped in its Scam then it can be very difficult to escape.

Q: Go Loan app is safe or not

Ans: Go Loan App is not a safe Application because its provide you loan only for 7 days and charged up to 40% 50%.

Q: Go loan app rbi registered

Ans. Go Loan is a fake application, it is neither registered by RBI nor does it have any NBFC partner. If you have taken a loan from this application then you are trapped in their Scam.

Conclusion:

Go Loan App Review: Friends, if you have read our post till here then you must have understood that Go Loan is a fake loan application.

It is easy to take loan from Go Loan application but once you get trapped in its Scam then it can be very difficult to escape, hence our opinion is that you should not take loan from this fake loan application.

Friends, now it depends on you whether you take loan from this application or not. We have given you complete information about this application. If you find any mistake in this post, then you can tell us by commenting.